Jerome Powell Predicts ‘Very Sturdy’ Financial Progress As U.S. Recovers from COVID Crash

The Federal Reserve Chairman Jerome Powell stated he anticipated U.S. financial progress to be “very robust” within the second half of this yr because the nation works its approach out of the COVID-19 crash and hard lockdown measures.

In an interview with CBS Information’ 60 Minutes aired on Sunday night time, Powell stated the outlook for the U.S. financial system had “brightened considerably” and claimed Individuals would see job creation and wider progress “beginning proper now.”

The Federal Reserve chair additionally accepted that some components of the financial system had been nonetheless struggling, significantly within the leisure sector, whereas others had been recovering and even thriving.

Chatting with CBS Information on Sunday night time, Powell stated: “I might say that this progress we’re anticipating within the second half of this yr goes to be very robust.”

Earlier within the interview, he famous that a number of forecasters within the personal and public sector had predicted financial progress of 6 to 7 p.c this yr, which might make it one of many highest boosts on report.

“We and lots of personal sector forecasters see robust progress and powerful job creation beginning proper now,” the Federal Reserve chair stated. “Actually, the outlook has brightened considerably.” Nevertheless, he famous that the restoration was “uncommon” in some respects, significantly in industries that contain extra in-person contact.

“It is only a very uncommon restoration. What you are seeing is a few components of the financial system are doing very properly, have absolutely recovered, have much more than absolutely recovered in some circumstances,” Powell stated. “And a few components have not very a lot recovered in any respect, but.”

Newsweek has contacted the Federal Reserve for additional remark.

Powell signaled his confidence in the way forward for the U.S. financial system a little bit greater than per week after the Inside Income Service introduced that greater than 130 million stimulus checks had been signed and despatched off below the most recent COVID invoice.

Individuals incomes lower than $75,000 had been made eligible for a direct fee of $1,400, with funds reducing out for these incomes upwards of $80,000.

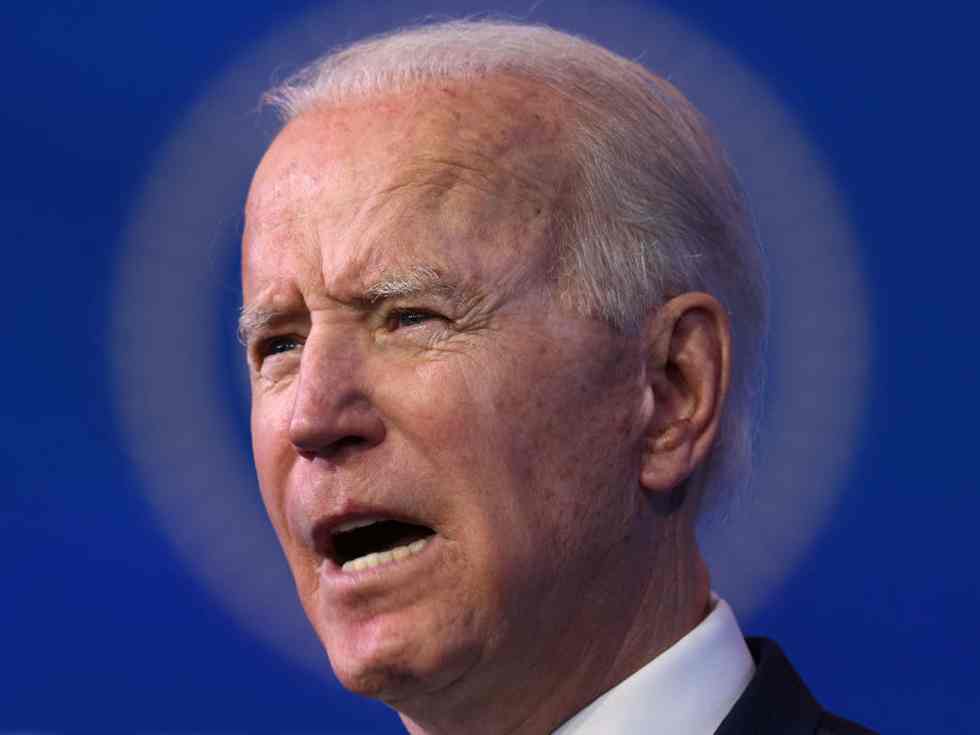

When President Joe Biden’s $1.9 trillion stimulus invoice was put to Congress, the stimulus checks had been touted as key to reviving the financial system and preserving struggling households afloat.

A number of polls have discovered client confidence rising for the reason that begin of this yr, marking a gradual return to regular after the shock crash in early March final yr. One ballot carried out by Morning Seek the advice of in March discovered that the stimulus package deal signed by Biden had spurred the most important enhance to client confidence when in comparison with different COVID reduction payments.