Bitcoin Could Trump the Greenback as Hedge Towards Inflation

Bitcoin seems to be a very good hedge in opposition to inflation as a result of, not like government-issued fiat currencies such because the U.S. greenback, the British pound, and the euro, provide of the crypto-currency is proscribed.

Usually, restricted provide and robust demand drives the value greater.

Not like the U.S. Federal Reserve, the nation’s central financial institution, there is no such thing as a overarching digital authority that may undercut the worth of Bitcoin by flooding the market.

President Richard Nixon took the greenback off the gold commonplace in 1971. Some consider this successfully made the greenback’s worth an article of religion.

From 1975 to only earlier than the COVID-19 pandemic hit in March 2020, the U.S. cash provide has elevated from about $273.4 billion to about $4 trillion. It elevated to about $6.5 trillion final November, largely due to coronavirus stimulus payments meant to maintain the financial system working.

President Joe Biden has proposed a brand new stimulus package deal totaling $1.9 trillion. If signed into regulation, greater than half of the full provide of {dollars} would have been printed because the pandemic struck.

Some worry that an elevated variety of {dollars} chasing restricted items and providers will result in future inflation.

In that case, inflation would hammer small savers and retirees on a hard and fast revenue who maintain {dollars}. Most cash market accounts at industrial banks pay 0.50% or much less in curiosity, and annual cost-of-living will increase in Social Safety are usually modest.

Does it make sense for Uncle Sam to borrow cash, even at present low charges, and provides it to people to spend? Does the nation face a scarcity of demand, or a scarcity of alternative to spend as a result of a lot of the financial system has shut down, together with eating places, bars, journey and leisure?

Regardless of the financial contraction on the top of the lockdown meant to curb unfold of the coronavirus, some sectors of the actual property market stay robust.

Those that remained employed, particularly the educated who can work remotely from dwelling on a pc, fled main cities for the suburbs and rural areas. This led to actual property worth will increase in some outlying areas.

Friedrich Hayek, who shared the 1974 Nobel Prize in Economics, urged the creation of personal currencies that will enable monetary establishments to compete for acceptance. He mentioned stability of worth can be the decisive issue for acceptance.

Hayek mentioned government-issued foreign money had all of the defects of a monopoly and prevented the event of recent strategies of change. Hayek died in 1992. Bitcoin was created in 2009.

Might Bitcoin and crypto-currencies be a part of what Hayek envisioned? Many see solely superficial parallels whereas others cheer. The controversy continues. Nevertheless, the worth of Bitcoin cannot be eroded by rising the provision as a result of the variety of cash is capped at 21 million.

Nonetheless, Bitcoin was lately valued at $29,881.56, down 5.53%. Earlier this month, the crypto-currency climbed to almost $42,000.

Main establishments are investing in Bitcoin, apparently as an inflation hedge.

Valuable metals comparable to gold have historically been used as a retailer of worth. But it surely’s not possible to understand how a lot gold exists on the planet and the way a lot may be economically mined.

The worth of Bitcoin has been risky prior to now, however volatility and threat aren’t essentially the identical. Final yr, the value of West Texas Intermediate crude oil briefly turned unfavourable as demand collapsed through the financial shutdown. However in an financial system constructed on oil, there was no threat traders would abandon the commodity and costs rebounded.

Rapid fears of inflation seem to have pushed Bitcoin’s worth greater.

The crypto-currency’s standing as a hedge in opposition to inflation could also be a very good guess provided that one other stimulus package deal is within the works and the brand new administration is discussing extra authorities spending on infrastructure and different applications.

However does investing in Bitcoin for the long-term signify something apart from desires of future worth appreciation?

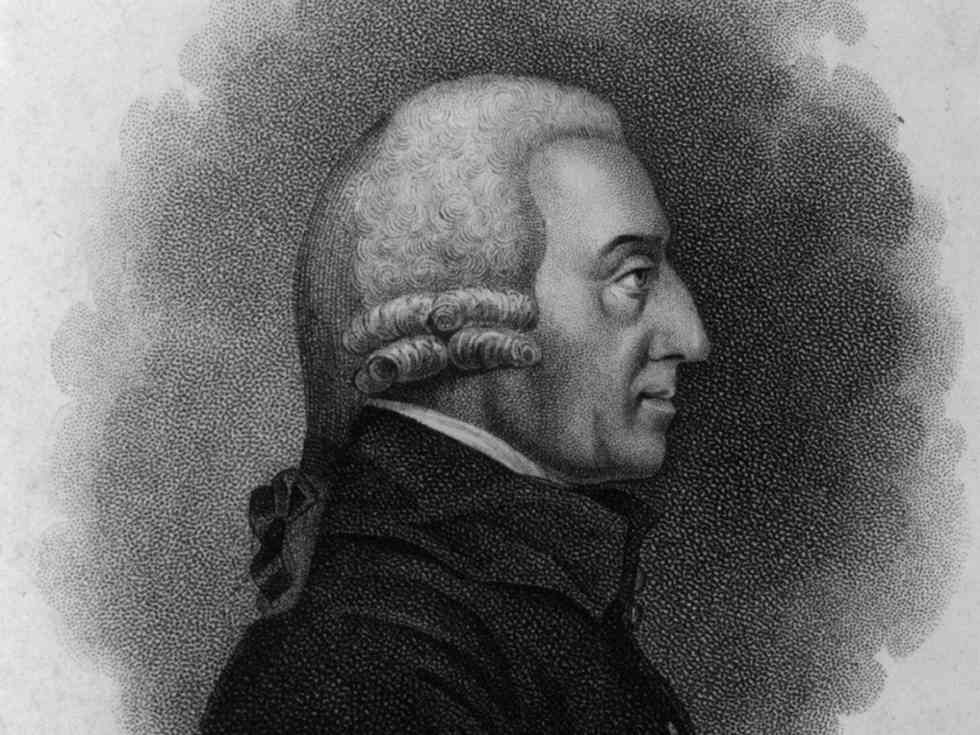

In The Wealth of Nations, Adam Smith famous:

“A prince who ought to enact {that a} sure proportion of his taxes needs to be paid in paper cash of a sure type may thereby give a sure worth to this paper cash, although the time period of its remaining discharge and redemption ought to rely altogether upon the need of the prince.”

Might we calm down if Bitcoin had been the coin of the realm as a result of it’s a decentralized cryptocurrency, so there can be no Bitcoin prince?

Then again, what would occur if a cabal of super-nerds—princes of the digital age—cook dinner up one other crypto-currency with fewer than 21 million cash in circulation?

Drawback is—we can’t be capable of ask Adam Smith for his opinion if it goes south.